Think Life Insurance Isn’t for Retirement? Think Again!

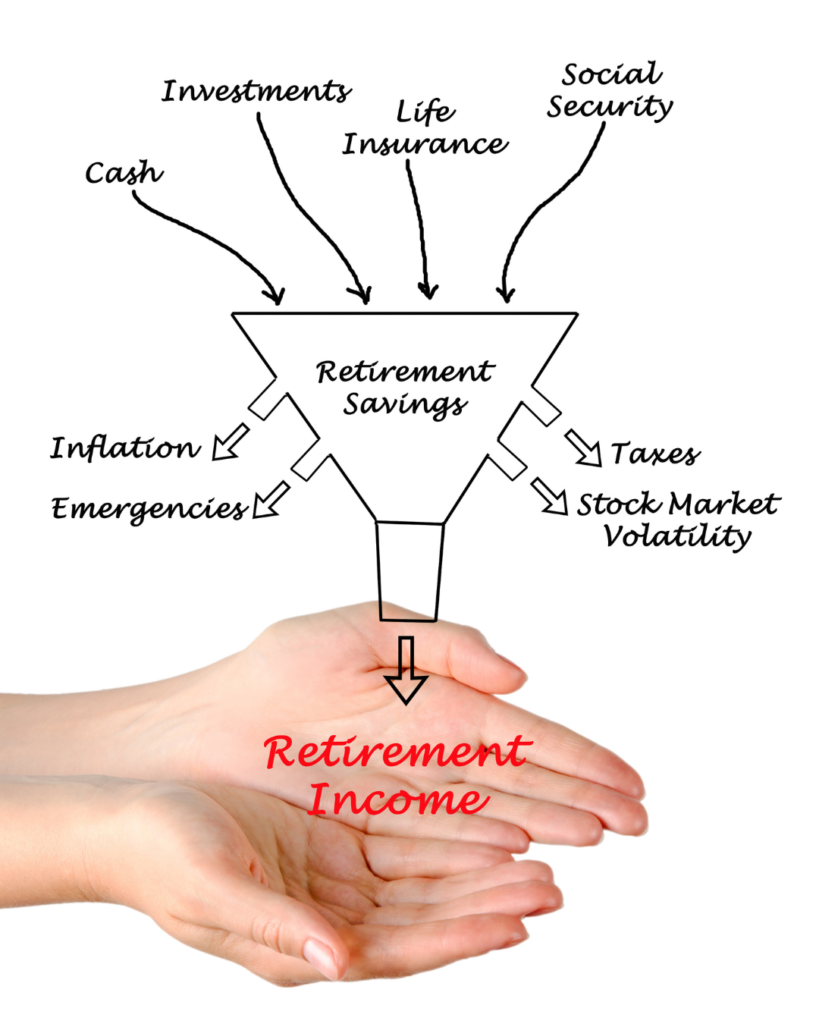

Life insurance is frequently misunderstood, often confined to the notion of providing financial support for families after one’s passing. While this is a fundamental role, it barely scratches the surface of its capabilities. Think life insurance isn’t for retirement? Think again! Life insurance is a versatile financial tool that can be tailored to meet broader financial objectives. The idea that life insurance has no place in retirement planning is not only misleading but potentially costly.

The most prevalent misconception is that life insurance solely serves to pay out upon death. In reality, more sophisticated forms of life insurance offer much more. These policies can diversify income streams, ensure long-term security, and even provide benefits during your lifetime. This traditional perspective overlooks how life insurance can integrate seamlessly into a comprehensive retirement strategy.

Types of Life Insurance and Their Relevance to Retirement

Grasping the different types of life insurance and their roles in retirement is essential.

Term life insurance, the most straightforward type, provides coverage for a set period. While its direct relevance to retirement may seem limited, it can be useful for covering pre-retirement years or protecting liabilities such as a mortgage during the early retirement phase.

In contrast, Whole life insurance offers lifelong protection coupled with cash value accumulation. This growing cash value can be accessed during retirement, providing a financial reservoir. The dual benefits of enduring coverage and cash value growth make whole life insurance a compelling choice for retirement planning.

Universal life insurance introduces flexibility, allowing policyholders to adjust premiums and death benefits based on evolving needs. This adaptability can be particularly beneficial during retirement when income and financial requirements may fluctuate.

Life Insurance as a Retirement Income Supplement

One of the nuanced benefits of life insurance in retirement planning is its potential to serve as an income supplement. Policies with a cash value component, such as whole life or universal life insurance, allow access to accumulated funds through tax-advantaged loans or withdrawals. This can provide an additional income stream to bridge gaps in retirement funding. Unlike traditional retirement accounts, accessing funds from life insurance may avoid tax penalties, making it an appealing strategy for supplementing retirement income.

Life Insurance as a Hedge Against Long-Term Care Costs

As long-term care costs rise, retirees face the risk of depleting their savings to cover these expenses. Life insurance can act as a safeguard against this financial strain. Hybrid policies that combine life insurance with long-term care benefits offer an effective solution. These policies enable access to the death benefit while the policyholder is still alive, assisting with long-term care costs and reducing the impact on retirement savings. This approach helps ensure that financial resources remain intact despite escalating care costs.

Legacy Planning Through Life Insurance

Beyond its role in income supplementation, life insurance is pivotal for legacy planning. It ensures that beneficiaries receive a tax-free death benefit, which can replace lost income, settle debts, or cover educational expenses. For those focused on preserving wealth for future generations, life insurance is a crucial tool, offering peace of mind that loved ones will be financially secure after the policyholder’s passing.

The Role of Life Insurance in Estate Planning

In estate planning, life insurance is a powerful tool. It can mitigate estate taxes, preserving more assets for heirs. Strategic use of life insurance can provide the liquidity needed to cover estate taxes, preventing the forced sale of other assets. Additionally, establishing life insurance trusts can exclude the death benefit from the taxable estate, offering further protection against tax liabilities and enhancing the overall estate planning strategy.

Evaluating the Need for Life Insurance in Retirement

Assessing the role of life insurance in retirement requires a thoughtful evaluation of personal financial goals and risk tolerance. For some individuals, maintaining a policy is essential for legacy or estate planning. For others, its necessity may diminish as other assets and income sources become sufficient. Balancing life insurance with other retirement resources, such as pensions, IRAs, and investments, is crucial for crafting a well-rounded and resilient retirement plan. An insurance professional can help determine this balance.

Retirement planning is a very complex process with many factors to consider and a lot at risk should you make a mistake. A do-over isn’t always possible. Working with a Retirement Income Certified Professional® could mean a world of difference toward a successful retirement.

Income stability during retirement is paramount, especially as expenses shift and healthcare needs evolve. Life insurance can act as a crucial safeguard, ensuring your loved ones are protected in the event of sudden financial challenges upon your death. Beyond merely replacing lost income, it can buffer against potential shortfalls in your savings or retirement funds. This security extends far beyond income replacement, offering a protective layer for unexpected events that are inevitable in retirement.

Conclusion

Once viewed primarily as a means to provide for dependents in the event of an untimely death, life insurance has now found its place in retirement strategies, offering protection, income supplementation, and a legacy.

*********

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 86-year-old father. She is an avid learner. She writes, speaks, and believes that helping clients live with dignity is her God-given mission.