The 3 Year Tax Planning Strategy To Protect Yourself From Rising Taxes

It’s tax time once a gain. So as part of your tax planning, I want to point out a very important tax consideration that can have a huge impact on your lifestyle especially when you retire.

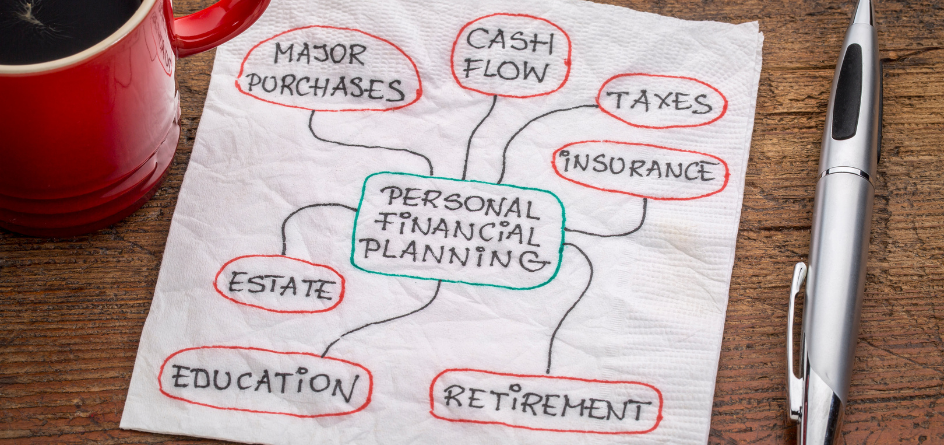

Planning is very important to me and as your trusted advisor, it is my job to let you know what you need to plan for because, with most financial planning, it takes time to set up a strategy. This particular strategy can take 3 years to implement from 2023 to 2025 so time is of the essence.

The current tax situation: A big tax discount

Are you aware that we are enjoying the lowest tax rates in the history of the United States? But it is not going to last forever. The current tax laws will sunset at the end of 2025. Therefore tax rates will be higher on January 1, 2026.

If you search federal income tax bracket history and you will see that in 1981, the top federal tax bracket was 70% with 16 different tax brackets. Today there only 7 brackets with the highest bracket at 37%.

How will this tax change affect you?

December 31, 2025, is when the current tax rates will end and revert back to previously moderately higher rates. It could possibly go even higher down the road to cover our country’s underfunded liabilities i.e. Medicare, Medicaid, Social Security, debt, national infrastructure and national defense.

This can impact your retirement by putting you in a much higher tax bracket in your retirement years. Conventional wisdom teaches saving for retirement in tax-deferred retirement plans such as 401k plans, IRAs, 403(b)s, 457, Keoghs and SIMPLE SEPs. Deferral simply means to be paid eventually, not to be eliminated. This is never good because the federal government can and does raise taxes whenever it wants to or needs to.

But in light of the current tax situation, deferring taxes won’t be a benefit, because you will end up deferring taxes at today’s historically lower taxes only to pay higher taxes on a lower income during retirement.

What you should do between now and December 31, 2025?

The simple solution is to gradually shift your money from tax-deferred accounts to tax-free accounts. Know that you will pay taxes in the year you do, so be sure to consult a tax professional to avoid paying too high in taxes that year.

Do this gradually IN THE NEXT THREE YEARS to avoid being in a higher tax bracket now (or the lowest increase possible) but be sure to complete it by January 1,2026 when tax rates go up permanently. You will be taking advantage of current lower tax rates and paying taxes now, so you eliminate taxes later.

Why tax planning is part of financial and retirement planning

Financial protection can bring durability and resilience to your portfolio. Mixing tax-free income from life insurance with income from tax-deferred and taxable sources creates an opportunity for better tax management. By investing assets in different financial accounts or locations with different tax consequences, You can improve your portfolio’s tax efficiency and seek to maximize after-tax retirement income.

The goal of retirement is to maximize income that you can use to enjoy the remaining years of your life. This can be achieved through sound planning which reduces or eliminates taxes in retirement. The conventional wisdom of deferring taxes does not make a solid retirement plan. Conventional wisdom leads to reduced income and quicker depletion of assets.

Reach out to us to help you maximize your retirement income. Not only do we help our clients eliminate or reduce their taxes, Furthermore, we have also been able to help our clients avoid running out of money while taking even more than the conventional 4% annual withdrawal.

In financial planning, there is the 4% rule where advisors tell their clients to take no more than 4% annual withdrawals from their retirement accounts to reduce their chances of running out of money while they are alive. Our clients have been able to take 5% or higher from their retirement assets.

Let me show you how! Book a meeting.

Women’s History Month

In celebration of Women’s History Month, I want to remind you of the accomplishments of women throughout the years in our culture and society. From science to politics, it is a chance to reflect on the trailblazing women who lead the way for change.

Here are two great articles that highlight women who have made significant accomplishments and contributions in the world of finance.

5 Historical Women in Money and Banking

13 Women Who Made Money History

***********

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 85-year-old father. She is an avid learner. She writes, speaks, and recognizes that her work in helping clients live with dignity is her God-given mission.