Tax Changes in 2022

So many things can change in a blink of an eye. Indeed, as they say, nothing is certain except death and taxes. But even taxes do change, so I gathered some tips from tax experts about changes that are coming in 2022.

Tax Changes Starting in 2022

Here are some important tax changes that we can expect in 2022. Be sure to talk to your advisor to plan ahead.

- The tax income limit for each tax bracket is increasing due to an automatic inflation-adjusted modification. This gives relief to taxpayers.

- Standard deductions will increase to:

$12,950 for single and married filing separately,

$25,900 for married filing jointly

$19,400 for heads of household

Having a business is still one of the best ways to reduce your taxable income and increase your itemized deductions. If you work a 9-5 from your home, you are unable to deduct your home office. But if you have a business you can deduct utilities up to the percentage of the square footage of your office divided by your total home square footage. Talk to a tax professional if you have questions about this. - Gift Tax and Estate Tax. The yearly gift exclusion limit for gifts to anybody will go up to $16,000. In 2022 a person can give $12.06 million to heirs, and $24.12 million per couple without paying federal estate or gift taxes. This is $300,000 of additional assets that a person can give away without incurring a 40% transfer tax. So it’s a good time to use this exclusion now before it’s cut in half. Consult an estate-planning attorney and an advisor if you have a large estate.

- Earned Income Tax Credit will be $560 to $6935 in 2022 depending on the earnings and number of children.

Child Tax is a credit for having dependent children younger than age 17 and is based on income, reducing after the taxpayer exceeds the allowable maximum income. These were advanced in 2021 unless you opted out. - Capital Gains Tax will be 15% or 20% depending on limits per each filing status.

Business owners, here are 5 Tips to Retain Top Player Employees

6. Corporate Tax may increase from 21% currently to 26.5% to 28%. Look into Executive Bonus Plans based on IRS Section 162 to decrease the impact of these taxes while providing fringe benefits to key persons.

7. Retirement Contributions will increase by $1,000 to $20,500. Those 50 and up can contribute $6500 more in their 401(k), 403(b), or 457.

IRA/Roth IRA limits are $6000, $7000 for 50 or older with income limits below $129,000 for single filers, and $204,000 for couples filing jointly. It will be reduced for those making above these limits and will stop for incomes above $144,000 and $214,000 respectively. Backdoor Roth IRA conversions can be done before the year ends and taxes will be due by April 2023.

42% of workers fear outliving their retirement funds.*

An Annuity guarantees your essential spending will be covered.

*Transamerica Center for Retirement Studies

Annuities have earned a bad rap mainly from the media and investing sites like Motley Fool and Fisher that say annuities are loaded with fees. This could not be farther from the truth.

Don’t let these myths about annuities stop you from reaping the benefits they offer. I bring annuities up because they offer financial certainty in uncertain times. They guarantee an income that will last throughout the life of the annuitant, no matter what.

Not all annuities are the same. The ones I’ve used for myself and my clients do not charge fees. The only fee they pay is if the client buys an optional rider with a fee or gets out of the annuity within the first seven or ten years.

My clients previously had their money in a nonperforming financial vehicle like a bank saving, bank CD, money market, or old 401k plan that is losing money.

In an index annuity, their money earns interest based on the increase in the index, but their money stays the same even if the index drops. They get both growth and safety.

Bonus: They don’t pay fees to keep their money inside the annuity. Money can grow without the interference of market loss, taxes, and fees.

In contrast, mutual funds charge fees as long as you are invested in them, whether the value of the fund goes up or down.

Taxes are paid only when money from an annuity is withdrawn.

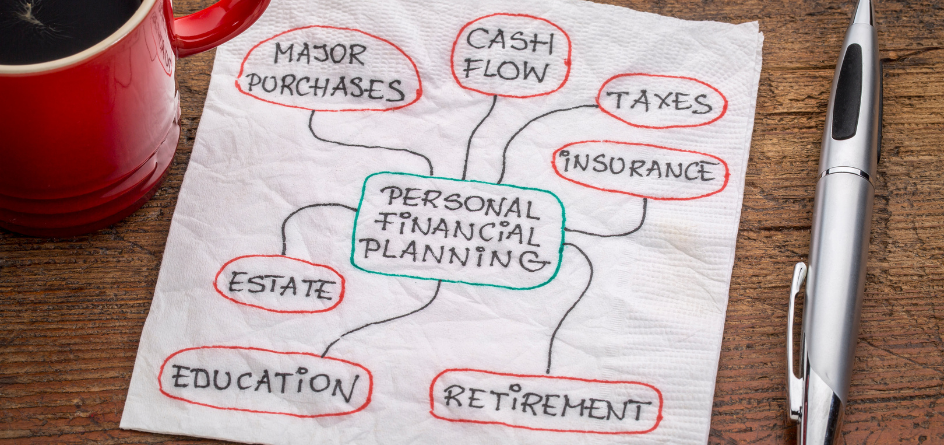

Ultimately, we are responsible for our finances no matter what happens to taxes or the stock market. We have to be able to adapt to change and know how to secure our future and our family’s future.

Planning is key. Partner with a financial partner who is knowledgeable about different strategies.

If you have nonperforming assets, reach out to see if annuities are right for you.

I’m growing my team! Do you know a coachable, motivated, ambitious, go-getter woman who wants to be in business doing what we do? Share this and contact me for more details.

Experiencing a DBMDR-Death, Birth, Marriage, Divorce, or Retirement? Let us help!

To find out more, schedule a meeting with us.

What Dignity Planning Is:

I help you plan to ensure you live in dignity throughout your life until your last breath.

Living in dignity means

- Being able to focus on getting better because money is not an issue

- Being able to live comfortably and pay your mortgage even if you’re sick and can’t work

- Being able to take care of your sick family member because you can afford not to work

- Being able to afford the best care even when not covered by health insurance

- Living a quality of life until your last days

- Continuing to take care of the people who matter most even after you’re gone or no longer can work

Ask Sheilla

Q: I have a child and heard about Gerber’s Life Insurance for kids. How does yours compare?

A: Getting life insurance for children or grandchildren is a thoughtful way of gifting the child something that will last their lifetime. They may not be able to play with it or see its value now, but they will certainly be there when they need it.

For children, we design flexible premium IUL or index universal life plans instead of the whole-life Gerber plans for children. Cash value accumulates interest based on stock market gains but is protected from market loss. This gives the cash value maximum accumulation opportunities!

This money can be used by the child for college, a downpayment on a home or car, a wedding, travel, or even retirement. In addition, living benefits are contractually included in the plans so if they get a qualifying illness, they can cash in on the policy.

Note that an IUL is also available for adults. To learn more, simply contact me.

Also this month, please join me in celebrating Women’s History Month and International Women’s Day on March 8. Follow me on social as I feature some great women in history.

Wishing you a great tax season!

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 85-year-old father. She is an avid learner. She writes, speaks, and recognizes that her work in helping clients live with dignity is her God-given mission.