Annuities Guarantee Your Retirement Income For Life

The rising inflation and interest rates have a lot of people worried. This has brought many stock earnings down and people invested in them losing money. Coupled with rising costs of goods, healthcare, and long-term care, many people see the future as all gloom and doom.

But not if you have been planning, and diversifying your assets in annuities. I believe that with proper planning, and the right financial strategies in place, retirement years can still be a time to look forward to instead of a time to fear.

Annuities offer solutions to many concerns of retirees and pre-retirees but the public is either misinformed or lacks understanding of what they are. I shed light on annuities below.

Why do retirees need guaranteed lifetime income?

First, let’s take a look at the problems that retirees are facing.

Problem 1: Record inflation

We have not seen inflation like this in 40 years. Higher inflation is usually looked at as a negative for stocks because it increases borrowing costs, increases input costs (materials, labor), and reduces standards of living. But probably most importantly in this market, it reduces expectations of earnings growth, putting downward pressure on stock prices. (Source: https://www.cnbc.com/2021/05/13/heres-why-stock-investors-are-watching-inflation-so-closely.html) We have already seen the stock market respond to this inflation. When a retiree’s income fails to keep pace with inflation, the automatic result is a reduced standard of living.

Problem 2: High-interest rates

High-interest rates cause the prices of bonds to go down. So bonds are also producing negative returns and leaving one’s retirement savings at a big loss and very little recourse to make money.

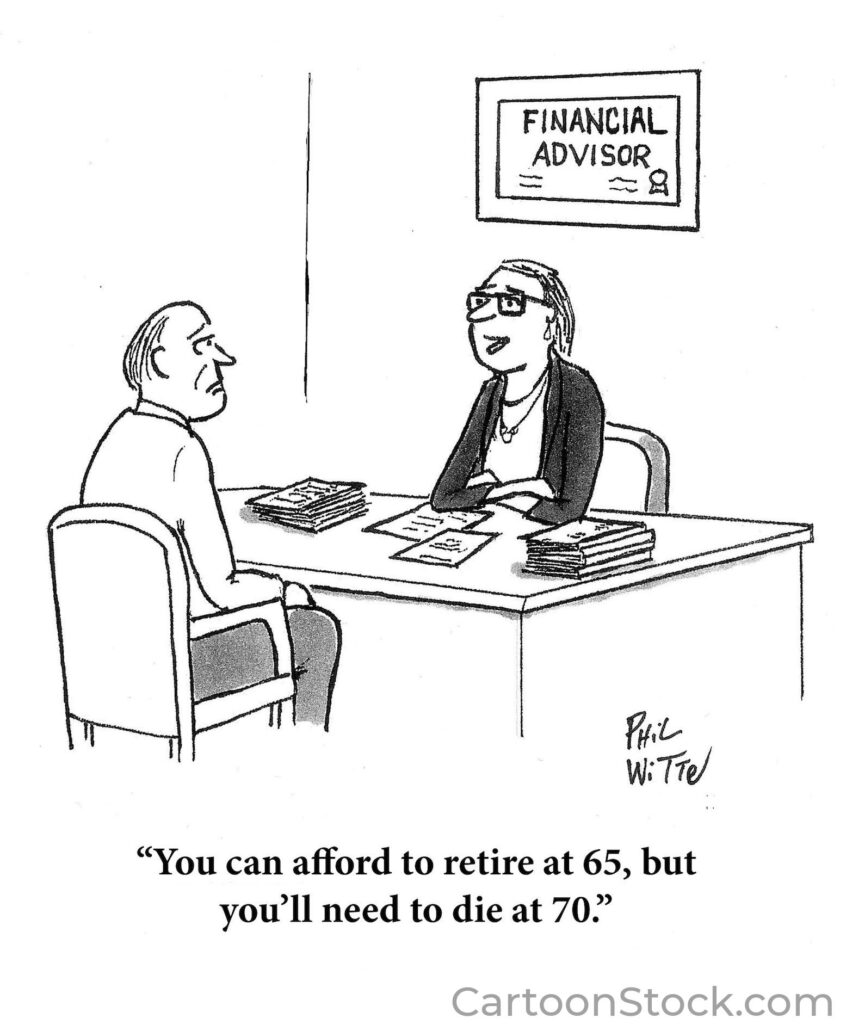

Problem 3: Longer life expectancy

People are living longer and the biggest fear of retirees is running out of money during retirement. How do we ensure that our money will last?

Problem 4: Pensions are disappearing.

Pensions are slowly becoming a thing of the past and rumors of Social Security going away fill news headlines. The Federal Old-Age and Survivors Insurance (OASI) Trust Fund and the Federal Disability Insurance (DI) Trust Fund trustees project that the combined Social Security trust funds will become depleted in 2034 (under different assumptions and projection methods, the Congressional Budget Office projected in 2021 that the combined trust funds will become insolvent in 2032).

“Retirement planning has newer risks than it did for our grandparents. It’s never been more important to be proactive and knowledgeable about secure retirement income planning.”

The Constrained Investor

According to David Macchia, founder and CEO of Wealth2K there are 3 categories of retirees: the overfunded investor, the underfunded investor, and the constrained investor.

The Overfunded investors are the lucky minority who have a surplus of cash relative to the amount of money they need to produce the income they need. They have a big cushion should market conditions become unfavorable. They can use any kind of strategy, no problem.

The Underfunded investors are those who have saved very little or nothing at retirement- they’re going to rely on Social Security.

The Constrained investors are in the middle where most people fall under. These are millions of people who saved consistently for retirement, but the amount of savings isn’t high compared to the level of income needed to support the investor’s minimally acceptable lifestyle. This does not mean that Constrained Investors have low savings balances. On the contrary, they may have accumulated millions of dollars.

But whatever amount of savings they have, all Constrained Investors share this important distinction: Absolute reliance upon their savings to produce a sizeable portion of the income they require to fund a minimally acceptable lifestyle. For them, there is little cushion and very little room for errors. They can’t run in and out of the market. They have no luxury of making mistakes.

They need a strategy that mitigates inflation risk, longevity risk, and timing risk. This is what an annuity does.

Annuity has STYLE

We covered inflation and longevity above. Timing risk has to do with the timing of when you decide to retire, meaning ten people, each with the same amount of savings but retiring at different times, will end up with different final sums by the time they retire. Fortunately, using a combination of annuities can help manage timing risk.

Moshe Milevsky, a finance professor at the Schulich School of Business at York University in Toronto, and member of the graduate faculty in the Department of Mathematics and Statistics, coauthored the book Pensionize Your Nest Egg, endorsing the use of annuities. He also published 15 books and is a fintech entrepreneur with a number of U.S. patents in the retirement income space.

He said, “Pensions are no longer offered to many workers. But that shouldn’t stop them from pensionizing their retirement nest egg. A sum of money at retirement isn’t a pension. How do I turn this into a pension? How do I pensionize a fraction of my estate? One way is to buy an annuity.”

So if you have saved money for retirement, you can use that to purchase an annuity, an insurance contract with guarantees:

Safety and protection of principal from loss

Tax-deferred growth

Yield from fixed rates or index increases

Lifetime income

Escapes probate

As increasing numbers of consumers look to purchase these products, they need to fully understand that fixed annuity contracts provide guaranteed fixed rates of return, protection of principal, and guaranteed lifetime income in exchange for certain restrictions. Fixed annuities are a financial tool that can be used to create tax-advantaged returns and guaranteed supplemental income in the later years of life.

The recent innovations in the annuity space have raised confidence and made these products a viable retirement solution and consumers are awakening to the value of fixed annuity products. Some now also offer optional benefits that can be used to pay long-term care and nursing home costs.

Still unsure about annuities? Learn the myths vs facts here.

The Caveats of an Annuity

Of course, just like any other financial tool, annuities are not 100% for everyone and not without any caveats.

The biggest one is it’s difficult to back out once purchased. Therefore only money that is invested or saved medium to long term should be placed in an annuity.

There are surrender charges on withdrawals above 10% in the first five to ten years, but these gradually fade as the end of the surrender period approaches (5 to 10 years)

If you are okay with withdrawing just 10% of the balance or the income payments annually in the first 5 to 10 years, you won’t be paying the surrender charges.

Taxes: Income and withdrawals are taxed as ordinary income

Since an annuity is considered retirement savings, withdrawals taken before age 59 ½ will trigger a 10% penalty in addition to taxes.

Is Annuity Right for You?

In assessing whether an annuity meets your needs, the above factors need to be considered and the benefits need to outweigh the mentioned caveats.

For retirees, the biggest benefit is converting a sum of money into an income stream they can’t outlive.

A research study found that adding an annuity to a portfolio can make it more sustainable and allow for a legacy. An annuity in your portfolio allows you to take risks. In other words, you do not have to put all of your nest egg in an annuity. You can put a portion in more aggressive investments because you now have the safety and guarantees of an annuity.

“Just as food sustains the body throughout its lifetime, an annuity sustains a client’s savings throughout their retirement. The annuity improves the sustainability of savings and legacy throughout retirement.” Susan Rupe, Insurance Newsnet

3 Action Steps To Get Started With Your Retirement Savings

1. Learn about your employer-sponsored retirement plan and start contributing to it up to the matching.

2. If you have an old 401k plan from a previous employer, you can roll that over to an IRA, which can be in the form of an index annuity so can add an annuity to your growing assets. Reach out to an insurance professional like myself to help you.

3. Maintain good records and revisit every year so you can gradually increase your savings as you finish paying off debt or get promoted and make more money. Diversify your savings across different channels with different levels of risk and tax treatments. If you need more guidance on this, reach out to us.

Experiencing a DBMDR-Death, Birth, Marriage, Divorce, or Retirement? Let us help!

Schedule a meeting with us.

What Dignity Planning Means:

I help you plan to ensure you live in dignity throughout your life until your last breath.

Living in dignity means

- Being able to focus on getting better because money is not an issue

- Being able to live comfortably and pay your mortgage even if you’re sick and can’t work

- Being able to take care of your sick family member because you can afford not to work

- Being able to afford the best care even when not covered by health insurance

- Living a quality of life until your last days

- Continuing to take care of the people who matter most even after you’re gone or no longer can work

Ask Sheilla

Q: I heard that annuities are only for those who are retired or about to retire. If I’m still young, I should be in more aggressive investments, correct?

A: While it’s true that most who see the value of annuities are in their 50s or older, age really has nothing to do with who it’s for or not, but rather on what type of investor are you, and how well you tolerate risk.

I have clients who are in their 30s who opted for the safety of an index annuity because they do not know the stock market and don’t feel comfortable taking the risk. It’s one good thing to keep in mind before engaging in any investment. You have to know the risks and be comfortable with them, be knowledgeable about the investment before putting all your money in it.

In addition to safety, another great reason to be in annuities is for diversification of assets. I’ve always believed in not putting all of one’s eggs in one basket. So if you have investments in the stock market, it’s good to have some assets that are shielded from market risks so that at a time when the market is down, you have security and money you can count on when needed.

A third reason people may want to consider an annuity, as discussed above is the need for a guaranteed income that will last as long as they live. No other financial tool can provide that kind of guarantee.

All these can provide peace of mind, safety of your principal, and even a decent return.

Bear in mind that there are many different types of annuities. There are fixed, variable, and index annuities. An experienced insurance broker can assist in determining the right type of annuity for your needs.

********

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 85-year-old father. She is an avid learner. She writes, speaks, and recognizes that her work in helping clients live with dignity is her God-given mission.

Are you loving what we share here? Subscribe to our blog and share it to your friends.