7 Steps To Achieving Financial Freedom This Year and Through Retirement

Whether you are just starting your career or nearing retirement, having financial freedom and financial security has always been a desirable proposition, one that is also achievable. As an immigrant from the Philippines, fresh out of college, this certainly was my goal when I moved to the US twenty-three years ago. I can confidently say that I have achieved financial freedom and you can do it too! In this blog, I will share with you the seven steps I followed to achieve financial freedom.

1. Decide what financial freedom means to you.

Financial freedom is a subjective concept, and the specific goals and aspirations may vary from person to person. It is not solely about amassing wealth but creating a financial situation that aligns with one’s values and provides the freedom to live life on one’s own terms.

For me, Financial freedom is having confidence in the state of my finances and its ability to meet the needs of my family even when an unexpected challenge comes our way.

It isn’t about retiring early like many would think. Rather, it means being able to do the things I want with my time, whether that’s traveling, homeschooling my kid, or just having the time to care for my dad, or my family, and pursuing my passion for helping people. I still work at my job as a PT a few days a week. I love being able to work more or less as I see fit. Working is not only practical with the cost of health insurance nowadays, but also meaningful.

For me, financial freedom is being able to financially meet the physical, emotional, social, and spiritual needs of my family and myself so we can live with dignity and be the best versions of ourselves, while doing meaningful work. I would be bored to death if I didn’t have to work!

WOMEN: DOWNLOAD THIS CHECKLIST TO SEE IF YOU HAVE THE ESSENTIALS TO LIVE AND RETIRE WITH DIGNITY

Understanding oneself is fundamental to financial success. Delve into your core values and priorities. What truly matters to you? Identify areas where you are willing to forgo immediate gratification in exchange for long-term financial gain. This self-awareness forms the cornerstone of prudent financial planning.

2. Commit to achieving financial freedom.

After you define what financial freedom is to you, make a commitment to attain it. This might seem like a no-brainer but very important, as it will require discipline and a lot of sacrifices on your part to attain financial freedom. Instead of binge-watching on Netflix, you will need to dedicate hours to educating yourself on how money works, credit, taxes, investments, insurance, and everything relating to personal finance. You can get started by reading my ebooks.

Embrace a growth mindset by viewing setbacks as opportunities for learning and growth. Invest in continuous education, both in financial literacy and personal development. A growth-oriented mindset not only propels you toward financial success but also equips you to adapt to ever-evolving economic landscapes. In addition, being well-informed will better equip you to make sound financial decisions and capitalize on opportunities that arise.

3. Pay yourself first.

This for me was the biggest game changer. This was how I was able to buy my first home. Many people do not do this because they pay themselves last. Paying yourself first means allocating a portion of your income to your savings before attending to other financial obligations.

How much to save depends on your income and your expenses. Therefore taking time to analyze your spending is key. Discern essential expenses from wants. Your core values can help you here. This way you can employ frugality without without compromising on life’s essentials.

Budgeting effectively involves allocating resources wisely, differentiating between needs and wants, and ensuring that every dollar serves a purpose in achieving short-term and long-term financial goals.

If you have not read the classic book The Richest Man in Babylon, by George S. Clason, I encourage you to. This was one of the best books on finance ever written.

4. Play defense.

Sports fans know the importance of defense. In finance, being financially free involves having a safety net for unexpected expenses or emergencies. This ensures that unforeseen financial challenges do not derail one’s overall financial stability.

Your savings can disappear in a brief second if you do not build protection around your income source as well as your savings. If you suddenly get sick or pass away, your income will be gone and your savings will gradually deplete. Your family is especially vulnerable to the loss of this income.

Life insurance with living benefits, both term and permanent, forms the bedrock of financial stability. These instruments provide a safety net for your family in unforeseen circumstances such as a serious critical, chronic, or terminal illness, as well as ensuring a legacy.

5. Play offense.

Financial offense if planning for what you expect to happen such as college or retirement. With the increasing life span due to vast improvements in medicine, expect to live into your 90s or even 100s. If you intend to retire at 65, that is 30 years you will need your retirement savings to last.

Elevate your financial standing by embracing the philosophy of incremental wealth building. Systematically increase your savings over time. This disciplined approach ensures that as your income grows, so does your financial security. It’s the compounding effect in action, propelling you towards your financial aspirations.

Debt creates a reverse compound effect so this is something you need to tackle with viciousness. Managing and minimizing debt is crucial for financial freedom. Strive to eliminate high-interest debts and strategically use zero to low-interest debts to leverage financial opportunities. By freeing up money you are paying in interest, and eventually paying off all debt, you can increase your savings.

6. Diversify.

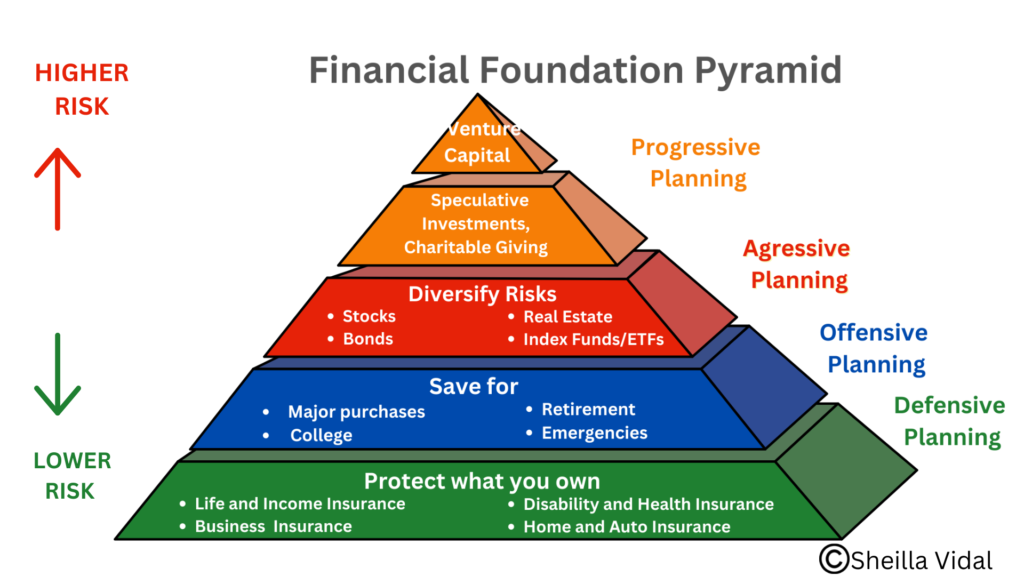

Now that you have established the foundation of your financial house, you laid the groundwork by saving for emergencies and other expected expenses, have life, health, and disability insurance in place, and signed up with your employer’s retirement plan, you can start acquiring assets such as real estate, stocks, bonds that come with higher risks. You can explore avenues like dividend stocks, real estate investments, or creating digital assets. Refer to the Financial Foundation Pyramid below.

Having a solid financial foundation allows you to take more risks.

I’ve always followed the principle of “Do not put all your eggs in one basket”. This is the idea behind diversification. Diversifying requires knowing what’s out there, learning the risks, and evaluating whether those align with your values and risk tolerance. Keep an open mind about learning different ways to invest but be careful. Always do your due diligence. Start small and gradually increase to minimize your risk exposure.

7. Mind your legacy. Give to charity.

Last but not the least, and not to be forgotten, is your legacy and contribution. While there are many different ways to give, and charities to choose from, evaluate which ones are tied to your core values and what matters to you. Think about how you want to be remembered when you are gone, for many generations to come.

The Bible reminds us to build wealth in heaven and not to forget that at some point we will leave this earth and move on to our eternal resting place. Let us not neglect our Christian duties and seek to fulfill our bigger role in the Kingdom of God. Read more on that here:

Giving and sharing our blessings with those who need it, allows us to remember where we started and to pay it forward. This in turn gives others the opportunity to create their own financial freedom journey.

Conclusion

Financial freedom refers to a state of financial well-being where an individual has the ability to make choices without being constrained by financial constraints. It is characterized by having the financial means to live the life one desires, without being overly burdened by debt, limited income, or financial stress. Financial freedom encompasses the ability to cover essential living expenses, pursue personal and professional goals, and withstand unforeseen financial challenges.

While attaining financial freedom is no easy task, it is achievable by anyone with determination, the right tools, and the right people on their side. If you’d like to work with me on your financial freedom journey, click here.

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 85-year-old father. She is an avid learner. She writes, speaks, and recognizes that her work in helping clients live with dignity is her God-given mission.