Three concrete ways to show your family your love this Valentines

Valentine’s Day is the time for chocolates and flowers to show our love to that special someone in our lives. But there are some concrete and lasting ways to show them that you love them that go beyond cute cards and teddy bears.

Show your family you love them in concrete ways that truly stand the test of time, by protecting their financial future, with these three simple tips:

1. Review your current insurance policies and financial plan

Making sure you are not under or over-insured is such an easy thing to do, but it can have a tremendous impact if not done regularly.

If you recently bought a home and your home or your mortgage balance is higher than your prior residence, make sure that you review your policy and add coverage.

If you had children or an income increase and you haven’t reviewed your policies, you could be underinsured.

If something were to happen to you, your family would be vulnerable and have financial hardships which could take a few years before your family can back on their feet, if ever.

So, take a few minutes and speak to a trusted advisor and make sure you’re covering your family for your current living situation.

2. Have an estate plan

People don’t like to think about planning for when they are gone. But which scenario would you like to happen: Would you like to dictate your wishes upon your death and have someone you chose to implement them?

Or would you like to let the state decide what happens to your young children or how your assets will be distributed? When you don’t have an estate plan, the choices are taken from you.

Would you rather keep your financial matters private or public? Because without an estate plan, they can become a part of the public record.

Finally, would you rather your family wait months or years to settle matters of your estate, or have it settled most efficiently upon your death?

An estate plan can mean a world of difference if you care about those questions. Having a will does not avoid probate which can be a significant headache for the people you leave behind. When your loved ones are grieving, you don’t want them to be overwhelmed with probate court on top of everything else they will be dealing with.

So, I encourage you to talk to an estate planning attorney who will help you with this. The investment now is worth it! I can refer you to an attorney if you’d like to get started.

3. Look into Life Insurance with a Living Benefit

If you have a life insurance policy, then you have a great start in protecting your family. But if you’d like to have peace of mind for not only when you’re gone, but also protecting your family while you’re still alive, then having a Living Benefit is a great option.

These are life insurance plans that can pay out a percentage of the death benefit while you are alive. This benefit will be available in the event of a critical illness such as a heart attack, stroke, or cancer, chronic illness or terminal illness.

This benefit option is available without paying an extra fee with our carriers. Contact me and we can review your plan or get you a quote so you can show your family you love them in ways they didn’t even know they needed.

My passion for protecting my clients’ families is why I put myself in your place when I consider all of the financial and insurance options that fit their needs best. I don’t suggest anything I wouldn’t use myself.

And because it’s February, this blog takes all of these matters to HEART.

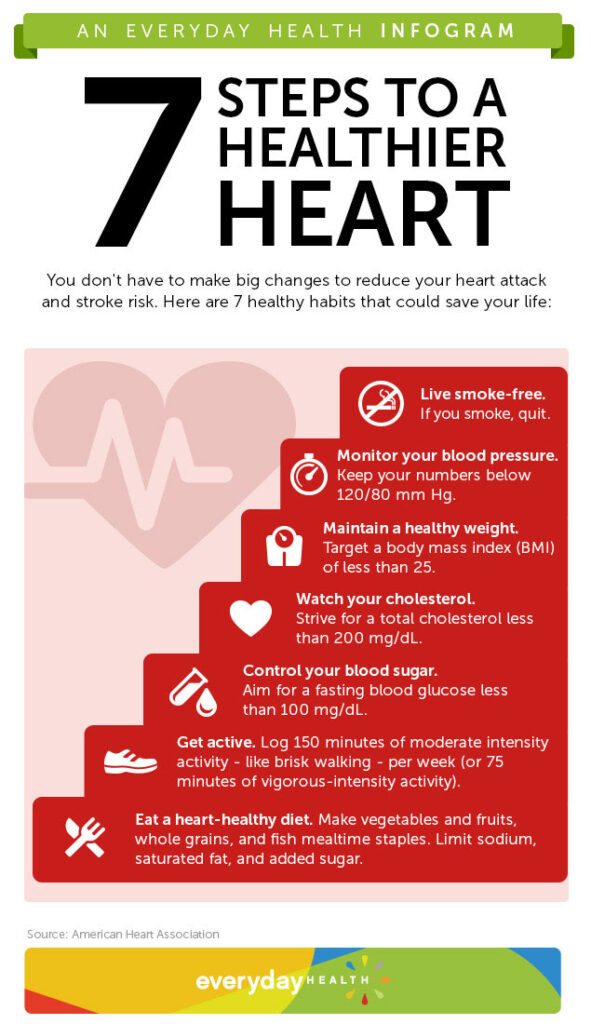

Read below for great heart health habits

February is Heart Health Month

Testimonial

“Thank you for being such as fantastic facilitator for me as I changed my life insurance policy. You had the natural ability to explain how my current policy could be improved economically while simultaneously listening to my concerns.

You took the time to understand my needs, and I really appreciate you being a reflective listener. Thank you for proactively updating me with the status of my application as well as notifying me when I was approved.

I was also very pleased when you were able to schedule my medical consultation with sensitivity to my busy schedule.

I truly switched my policy solely because of you, and I will be recommending you to everyone.” JH

********

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 85-year-old father. She is an avid learner. She writes, speaks, and recognizes that her work in helping clients live with dignity is her God-given mission.