Life Insurance Q and A During Covid 19

During these challenging times, I’d like to provide a connection and a resource. I come from a healthcare background as a Physical Therapist. I’m with you in this COVID-19 pandemic as a mom, healthcare worker, and living benefits specialist. You can count on me to help you, whether in answering questions or providing needed coverage.

I share below the answers to questions that many clients are asking.

What people are asking me right now

Q: I’m not working right now due to the Covid-19 shelter in place and I can’t afford to spend too much. Are there any life insurance options available for me?

A: Yes, absolutely! There are options available for any budget no matter how big or small. There is also an option to start the premium payment on a specific date you choose. Your premium depends on many factors, such as age, health history, amount of coverage, and length of coverage (for example: 10 years, 20 years, etc). While I can’t change your age and health, I can adjust the coverage amount and length of coverage to give you a customized quote that works within your budget while giving your family the protection you need. Because peace of mind is priceless!

Q: Do I need to have a medical exam to apply for life insurance?

A: Right now because of the exceptional circumstances, I’m seeing many insurance carriers not require a medical exam for the first time in my career. The insurance carriers are approving without a medical exam because it’s not practical for many to be seen by a health provider during the quarantine. You can take advantage of this to get the coverage you need as soon as possible. Then you can do a medical exam after the shelter-in-place to get a better health rating. If that is something you want to take advantage of, we can submit an application and see if you get approved.

Q: What will happen if I test positive for Covid 19 during the application process before I become approved?

A: If you test positive for Covid 19 before the application is approved, they will postpone the application until you have recovered.

Q: What happens if I become positive with COVID-19 AFTER I get approved?

A: If you did not become positive for COVID-19 19 until AFTER you became approved and the policy is now in force, this will not affect your coverage. If something happens, after your policy is active, then you are covered.

May is significant for many things

May is a month of celebration because many birthdays are celebrated in our family. My sister, nephew, aunt, cousin, and myself all have May birthdays. It also signals the coming of summer and Mother’s Day.

To all you mothers, I wish you all a Happy Mother’s Day. I hope that you are all taking the time to take care of yourselves. We tend to take care of others around us first. And we all know you can’t give from an empty well, so please give yourself the love that you provide to your family too.

May is Mental Health Month

It is very timely indeed that with all of the stresses going on, May is Mental Health Month. NAMI (National Alliance on Mental Illness) joins the movement to bring awareness, educate the public, and fight the stigma of mental illness. If you know someone who is battling mental illness, they need our support more than ever. Let’s reach out to them, let them know about resources available through NAMI, and let them know “ they are not alone”.

May is Stroke Awareness Month

Did you know it is the third leading cause of death in the United States? It is the leading cause of long-term serious disability in the United States. Strokes can and do occur at ANY age. Nearly one-fourth of strokes occur in people under the age of 65 and a stroke occurs every 40 seconds in the US.

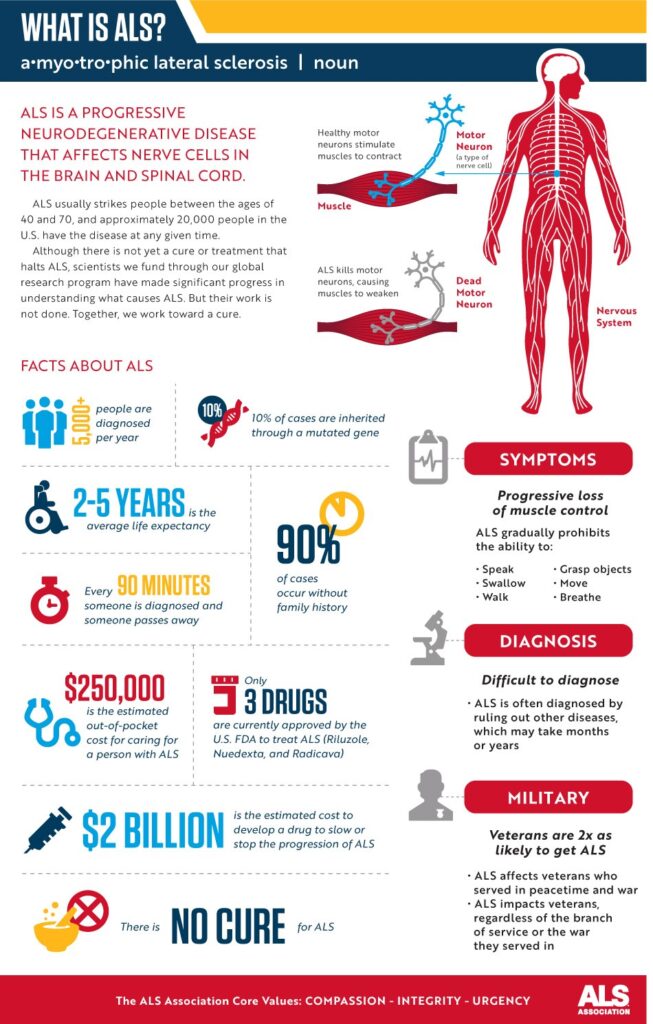

May is ALS Awareness Month

ALS wasn’t familiar to many until the “ice bucket challenge” became popular on social media a couple of years ago. ALS (Amyotrophic Lateral Sclerosis) also known as Lou Gehrig’s disease is a progressive disease that affects the nerves that control movement. The cause is not known in 90% to 95% of cases and there is no cure.

See infographics on ALS below.

Financial planning can help

Because stroke and ALS can happen randomly to anyone, including the people we love and care about, it is good to be proactive in our financial planning. I believe it is my responsibility to take care of my family and to continue to do so even in the face of an unexpected illness.

Additionally, because of Covid 19, there has been (and I think there will continue to be) a higher incidence of chronic illnesses such as heart disease and cancer due to limited doctor’s visits. It’s more important than ever that we take care of our health and financial well-being.

Our critical illness rider can cover you for these illnesses. You will be able to access a portion or all of your life insurance benefits if you need money to help pay for care so you can work, or get a break from caregiving.

Caregiving costs are the number one financial need of many patients with critical and chronic illnesses. Becoming proactive and preparing for the financial care of yourself or your loved ones in the event of an illness can lift a huge weight off of your family’s shoulders. If you’d like more information, I’m here to help.