Conversations With Kids About Money

One of the things I’m passionate about is the nurturing and education of young minds, especially when it comes to values and financial literacy. There are a few values that children can learn from knowing how to manage money- like gratitude, ownership, responsibility, and frugality.

Read on to learn how you can start having meaningful conversations with your kids about money, no matter what their age. You can teach your children, nieces, nephews, or grandchildren about the concepts of budgeting, spending wisely and saving.

But please don’t keep it a secret :). Share this post with people you know and on your social channels. Together, we can improve the financial literacy of our communities!

The cost to raise a child from birth in 2022 to an 18-year-old adult is $272,049. ” -The United States Department of Agriculture

Educating Your Kids About Money

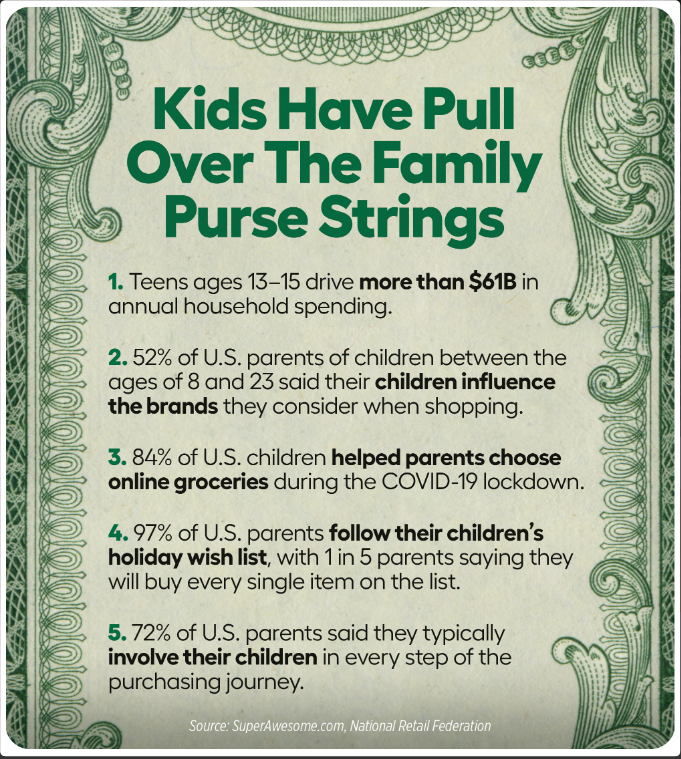

Whether your kid is college-bound, High School bound or still in elementary it is never too early (or too late!) to start educating them about money. As you can see from the infographics above, raising children comes with a high price tag. And getting them on board with the family budget can do wonders for your finances. But how do we start? Here are the steps:

Step 1. Talk about money and how it is made or earned.

We get paid for work done. Kids can “earn money” by doing chores around the house or selling something they made. With their “income” we can then teach them how to save some, give some and spend some. You can set up a jar or envelope system with labels on each. Explain why each is important. “We save so we have money available when we need it. We give because that is one way we show we care or love someone. Having money in the Give envelope allows us to buy a thoughtful gift for someone else.”

This is a good place to start especially for young kids.With older kids, as their ability to understand math and money concepts increases, we can introduce the family budget.

Step 2: Talk about the Family Budget

Before we talk about the family budget, establish your family values around spending and saving, as well as your long-term and short-term goals.

Talk to them about this in terms they can understand like “We want you to have a college education so we are saving money for that”. Hopefully, you have already done some prework on this. It doesn’t help our credibility if we didn’t have a budget, to begin with.

Explain the difference between income and expenses. A visual might help in that, you can state income is money coming in, whereas, expenses is money coming out.

Explain that a budget is the way our family decides what our financial priorities are, and helps us spend in order of greatest importance based on our income and goals. Done right, this allocation of money gives us the ability to spend without guilt, assuming we’ve included adequate savings as part of our plan.

Step 3. Help them create their own budget as they earn money from chores or gifts.

This is especially important for preteens and teens as it will help them think through all the expenses attributable to them and go through their own process.

1. Brainstorm the categories of expenses-clothes, food, piano classes, sports and everything else they spend or that is spent on them.

2. Assign costs to each expense. They might struggle with knowing how much each cost, so you can help with this.

3. Distinguish between needs vs wants. Introduce the idea of fixed vs discretionary expenses. Play a game during a car trip and name stores, billboards, or ads on commercial trucks that you pass and ask whether it’s a need or want.

Step 4: Make it a habit.

This is not a one-time conversation with your kids and then you’re done. Continue the conversation as things change in your family goals and budget like if you want to go to Disney or if the washer broke and you need a new one.

We model to our kids how to make decisions about purchases and also teach the importance of saving for emergencies. Then we can start introducing other financial concepts such as saving for long-term goals, stocks, insurance, and other ways to invest and grow money.

My son who is 6 years old learned about life insurance from Sponge Bob, to my surprise! They are capable of understanding more than we think, we just have to explain it at their level.

Benefits of Money Conversations With Kids

Here are some of the most important benefits of educating your children about money now:

- They understand how much items cost which allows them to cooperate and participate in following the family budget. No whining, tantrums, and repeated requests for things they want but don’t need.

- It promotes ownership of the decision-making process and allows for thoughtful and responsible spending

- It enhances their gratitude for purchases made by them and members of their families.

- It cements values that you want your kids to carry throughout their life.

- They learn how to establish their own budget which can have a lifelong impact. They can begin to shape their financial future. And that, my friends, is worth gold.

Follow me on Instagram and Facebook, to be in the know of all things planning right to take care of the people you love.

According to Education data, in the year 2019-2020, the average total price for a college degree was roughly $122,000

Did you know that an IUL is a great way to save for your kids’ future expenses, including college?

An IUL or Indexed Universal Life is a type of cash-value accumulating life insurance plan that grows tax-free according to the performance of the index. The money is protected from market risk because it is not directly invested in the stock market.

If you have an IUL for your child, it shouldn’t stop there. Be sure to review your policy and show the child what it’s doing for them. Talk about the possibilities of what the money can be used for. Explain that is meant to be used in the future. You can call it a college fund, nest egg, or dream fund.

Most of all, don’t be shy to tell them the reason behind it- that you love them and you want the best possible future for them!

.

My Dignity Plan Focuses on 3 Often Forgotten But Super Important Areas:

The 3 L’s: Longevity, Long Term Care, Legacy

Ask Sheilla

Q: I want to start saving for my kid’s college. I heard about 529 plans. What is the difference between saving in a 529 Plan and IUL?

A: I think all parents will agree: college is expensive. For more estimates on how much a 4-year degree in college costs, go here.

A 529 plan is a state-sponsored tax-advantaged education savings plan for college and private K-12 schools. You pick the investments to allocate your money into and the money grows tax-deferred. Withdrawals are also tax-free if they are used for approved (qualified) education expenses like tuition and fees, room and board, textbooks, meal plans, technology, computers, and necessary supplies, including special needs equipment.

Drawbacks of 529:

- Since it is a college savings plan, it can only be used for education expenses, and any excessive withdrawals will incur a 10% penalty.

- Second investment options and performance varies per plan. So be sure to study the plan and investment options.

- Third: The investments have fees and can lose money based on the market performance of the funds you selected.

While an IUL also allows for tax-deferred growth and tax-free withdrawals or loans, there is no regulation regarding qualified expenses. Money can be used for food allowances, travel, transportation, health insurance, gym membership, cell phone, and other expenses unrelated to education. The money in the IUL goes up with the market but has a 0% floor so it won’t lose money even when the market is down.

Drawbacks of IUL:

- If the IUL is not funded early or well, the money will not be enough. But that goes for the 529 as well.

- Second, the IUL has a surrender period of 10 to 16 years which limits the amount of withdrawal during those years. Planning ahead can help remedy this.

Both the 529 plan and IUL provide the advantage of tax-deferred growth and tax-free withdrawals, except there are penalties on the 529 plans if you don’t follow the rules. Whereas the IUL doesn’t have restrictions on how the money is spent and does not lose when the market is down.

Sheilla Vidal is a Retirement Income Certified Professional RICP® and life insurance broker. Sheilla is also a physical therapist, wife, mother of two, and one of the caregivers for her 85-year-old father. She is an avid learner. She writes, speaks, and recognizes that her work in helping clients live with dignity is her God-given mission.